For as long as I’ve been a founder, investor, and advisor, I’ve been told—and told founders—to take their killer tech that wildly optimizes cost / revenue / life / etc. and market the shit out of it to low hanging fruit customers to gain traction and then raise capital, grow, scale, etc. And I still believe that is how to sequence building a successful venture-backed startup. Some (obvious) examples below.

Almost without exception, the biggest (and most obvious) stumbling block is convincing any customers to try or buy the new widget. But what if there were a way to eliminate the arm twisting plea for customers? There is. And it’s not new. It’s just… expensive.

Enter: Private Equity.

The PE approach would go something like this. Build that killer tech that wildly optimizes cost / revenue / life / etc. But rather than marketing the shit out of it to low hanging fruit customers to gain traction and then raise capital etc… *BUY* one or (preferably) more of the customers that will leverage said killer tech to make them (in aggregate) a better / more formidable / faster growing / more profitable operator than anybody else in the market; that is, if that killer tech is really that, well, killer.

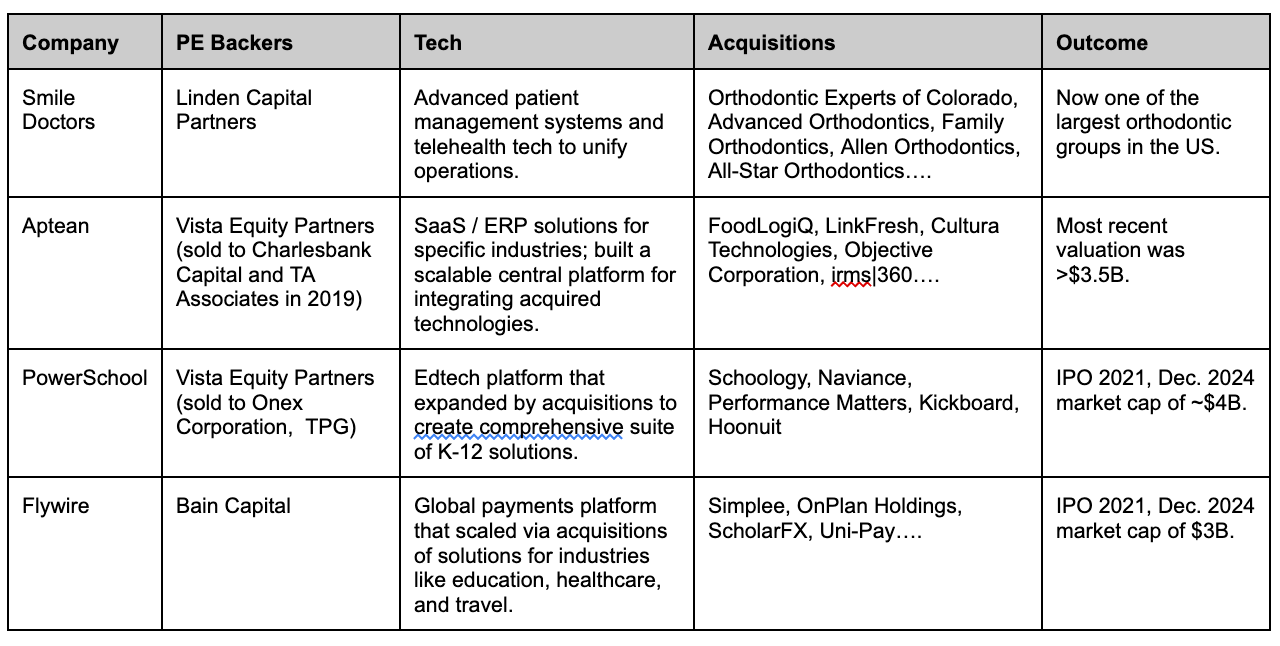

Neither approach is new and neither is easy. And large corporations like Amazon, Google, and Nvidia have been doing this for years. Specifically, they build or (more often) acquire a technology that scales over their existing platforms to gain a material competitive advantage. For Amazon.com it was Kiva (warehouse robotics); Google, Android (mobile OS); and Nvidia, Mellanox (Infiniband). But the table below is a smattering of private equity backed companies that were created and / or expanded in a (sorta) similar way.

“Terrific observation, Porch,” you say. “But wtf do we do with this observation, Dog?” you ask. Three things. (Because there are always three things.)

Build killer AI apps.

Finance killer AI apps.

Roll-up legacy(*) companies and leverage killer AI apps.

I’ll skip (1) and (2) because I don’t know how to do (1) but plenty of my nerd friends do; and (2) is the whole venture capital shtick. For this post let’s focus on the PE / AI roll up racket. But first (as always) a smidge of (recent) history.

The Cloud is a Crystal Ball….

At AWS we had a killer tech (cloud computing) that wildly reduced the cost, speed, etc. of deploying digital applications. Our startup BD group, which I co-built (after joining the 13 other people that started it before me), doled out credits like Oprah Winfrey on a devops coke bender. But “we” also birthed a private equity engagement group (from our startup group) that basically went to PE funds and said: “Hey, shut down your portfolio company data centers and move to the (AWS) cloud and you’re gonna make (a lot) more money.” And consulting (and accounting) firms like Accenture, PwC, Deloitte, and McKinsey got themselves hired by the Fortune 500 to do the same thing. Surprise: it worked.

Unsolicited advice to OpenAI, Anthropic, CoreWeave, Lambda, Hugging Face, Mistral, Perplexity, etc.: do this too. [UPDATE: I sat on this unfinished draft since last year because I got, um, busy - more on that another day - but since then OpenAI hired my old AWS colleague Paul Zimmerman to build and run their PE team. Smart - both him and hiring him.] The consulting companies are already on the hunt; case in point, I got cocktail party cornered by a consultant last summer hopped up on doing this for their clients. Might also explain why AWS’s former head of AI landed at PwC to run “innovation”; i.e., to advise all of their clients that already ported to the cloud to now make comparable moves with AI platforms.

On the off chance that you are not a multi trillion dollar corporation (or consulting firm servicing multi trillion dollar corporations), however, you’re likely to need a different approach. I suspect the “move to the cloud” and vertical SaaS roll-up strategies have played out; so today’s strategy would include GPU compute enabled technologies like AI (and blockchain and robotics and….)

The AiPE Rollup©

I have coined the term “AiPE Rollup” (Ai PE rollup) to describe this brand new thing that I invented (after other people did).

Though obvious and perhaps inevitable, AI is already impacting functions like customer service; e.g., Klarna said that its AI chatbot created with OpenAI handles two thirds of customer service chats (>2M conversations), which translates to the work of ~700 people. There has been a fair amount of skepticism about how impactful this really is, but the message should be clear. This is happening. Now. And it’s going to be even more prevalent even sooner than you think. If you haven’t experienced this directly, then next time you’re on the horn with the bank or the airline waiting for or even talking to an agent, try using ChatGPT instead to look for the same info. I did this with both Chase (Bank) and Delta (Airlines) in the last month and the results were astounding. (PS - if you haven’t tried this I recommend it, unless you’re a masochist.)

Clearly companies will leverage AI to optimize their own cost / performance, but we’re starting to see the beginnings of “AI rollups”; that is, amalgamating (more “legacy”) businesses and leveraging AI to make the combined company (much) more competitive than, well, competitors. The sewing circles were abuzz with activist chatter re companies like Five9 (NASDAQ: FIVN), which makes contact center software. And frankly any business process outsourcing company could be an opportunity for a similar model; e.g., sales / prospecting, telemarketing, technical support, data entry, HR, and other front / back office functions. A few (other) specific efforts I’ve seen recently include Count (accounting) and Metropolis (parking). I can’t imagine law firms and consultants and others aren’t in the crosshairs as well.

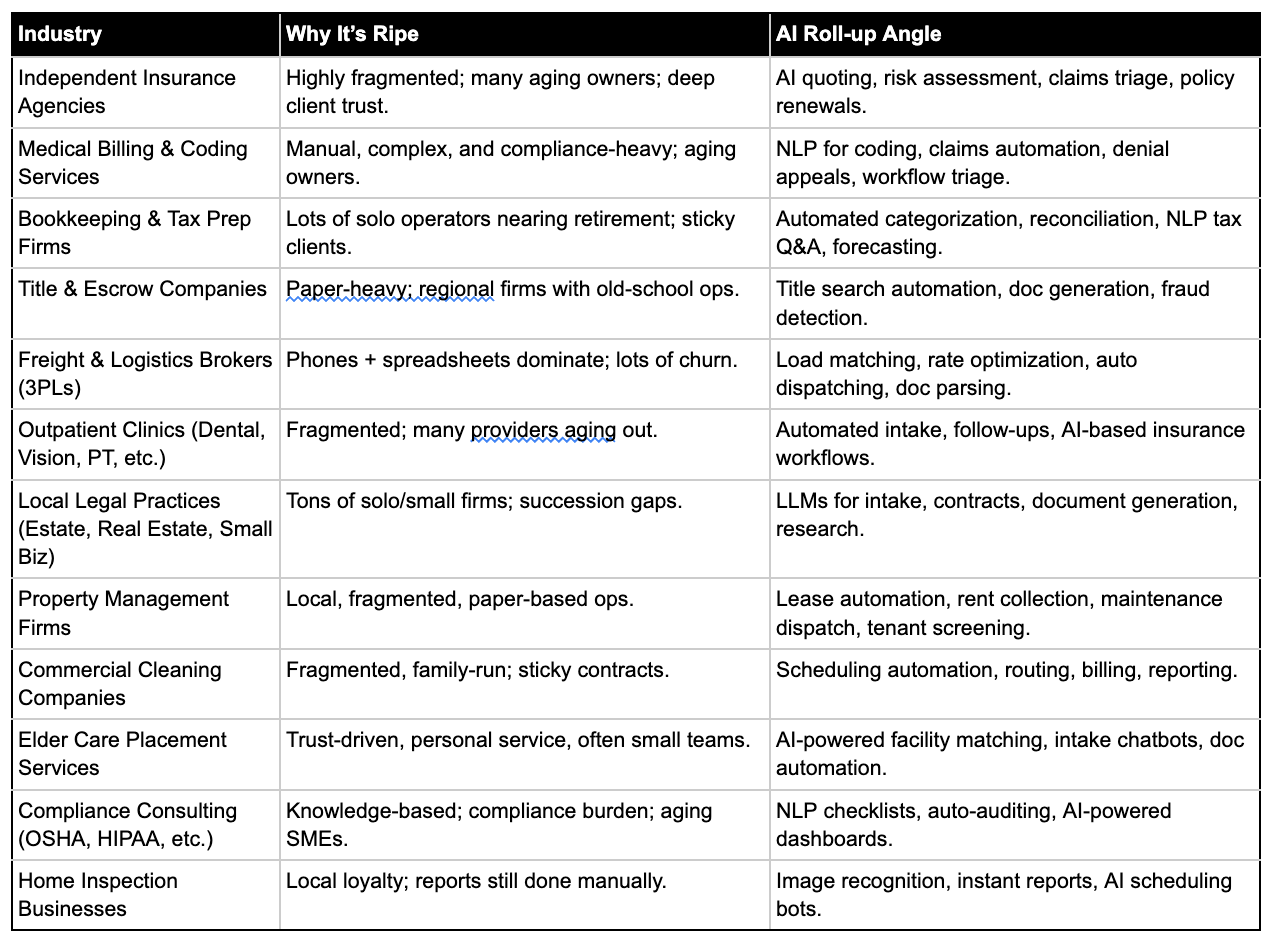

To come up with some preliminary ideas, I used (wait for it) AI (ChatGPT to be specific, but almost any model will do). Here’s the prompt:

Hi! [I’m always polite to my AI bots; i.e., our forthcoming overlords - plus I also used ChatGPT to help me refine the prompt itself so….] Can you list industries or business categories in the US that meet the following criteria:

Highly fragmented with many independent operators (including SMBs, middle-market firms, sole proprietors, or mom-and-pop shops).

Often run by aging founders or families — with increasing numbers looking for exit strategies, retirement, or succession planning (but without successors).

Operationally “old school” — meaning they rely on outdated tech, spreadsheets, manual workflows, fax machines, paper forms, or in-person processes.

Require significant human interaction, communication, or coordination — but not necessarily physical labor (e.g., managing paperwork, customer service, quoting, scheduling, compliance, etc.).

Burdened by repetitive back-office work, paperwork, or process bottlenecks that could be automated or enhanced with AI tools (e.g., LLMs, agents, document intelligence).

Typically have a loyal customer base with long-standing client relationships and predictable recurring or referral-based revenue — so that customers are likely to stay post-acquisition.

Important exclusions:

Avoid businesses that are already heavily digitized or centralized (e.g., modern SaaS startups, consumer tech, social media, crypto exchanges).

Exclude one-off, seasonal, or hard-to-standardize businesses like independent authors, fine art galleries, or craft-based makers.

Bonus points for:

Boring or overlooked industries that are surprisingly profitable.

Industries with compliance, regulatory, or documentation burdens that are well-suited for AI automation.

Verticals where AI can create a clear operational moat post-rollup.

And here is the table my digital buddy made for me:

So, time to roll up the sleeves, find a pile of money, create some (AI) tech, and go on a shopping spree.

Meet Marty the Stop and Shop Robot

But if you really want to jump ahead of the line, look no further than… burritos. Chipotle’s new CEO has made his desire to leverage robots in the kitchen very clear. You’ve probably already used kiosks to order at McDonalds and comparable suboptimally healthful indulgent eateries. (NB: Big Macs are my favorite food.) And robots in manufacturing, factories, and fulfillment centers are hardly new. But we may be amidst the AI and robotic transformation of personal / retail presence. I (literally) ran into this guy (gal?) “Marty” at Stop and Shop the other day - this is a GIF of the actual video after I ran into, um, Marty. (Have we yet settled on gender pronouns for robots?) He (she) was just rolling around making sure there were no spills, but is it only a matter of time before the inside of a grocery story looks like the inside of an Amazon warehouse? Prossibably©.

Got an overlooked vertical or PE play you’re seeing? Drop me a line :)

—

prossibably adverb

/ˈpräsəˌbablē/

Definition: Used to indicate something that is more likely than possibly but not quite as certain as probably. A word for the indecisive optimist.

Example: “Are we going to the beach tomorrow?” “Prossibably, if the weather holds.”

Origin: Blend of possibly and probably; coined in the 21st century to fill the murky middle ground of likelihood.

Do it Levy