Valuation :: 1/risk

I wrote about the perfect pitch here. After creating a (perfect) pitch deck, the next questions I get most frequently are: (1) who should I pitch? (2) can you connect me? and (3) what’s my valuation? And the answers are: investors that do your stage and can be most helpful (outside of money); sure if it’s relevant, see here; and the market (i.e., investors) will set the price. I’ll explain, but first - today’s words of the day are: paamayim nekudotayim, which I learned (today) means “two dots” in Hebrew, which is ironic given it is used to define the double colon (which technically has 4 dots) that is used to indicate scope resolution in many programming languages. It also signifies “is to” when expressing a ratio in math which was my attempt in this post’s title. It’s also a lot easier to say “double colon.” So let’s investigate how valuation :: 1/risk….

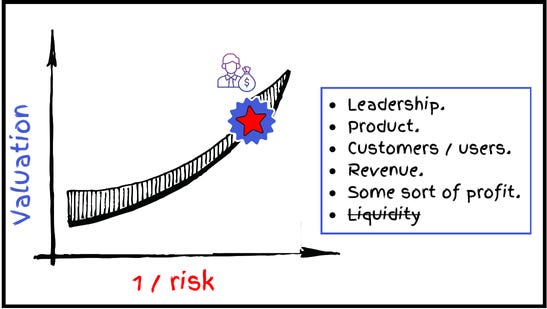

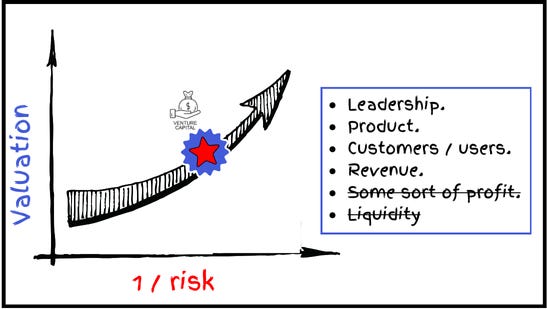

I’ve drawn the graph above countless times (so now I’m posting it to save myself a few minutes). The Y axis is valuation. And the X axis is 1 / risk; i.e., the further you go out, the less risk the investment has. This graph, as simple and obvious as it is, will tell you what stage you are and, consequently, which investor stage you should target. (NB: all of the questions, stages, investor classes, etc. are approximations and will vary, but hopefully this provides some insight and perspective into how to do this….) Let’s pretty this up a little….

Again, this is hardly exact, but each star on the line marks another stage, which is another combination of valuation and risk. And to mitigate risk; i.e., increase valuation; i.e., go up and to the right, a founder needs to satisfy a number of questions. In general, for an investor, the risk elements are: leadership, product, users, revenue, profit, and liquidity. And as the founder mitigates each question (risk), they can move up that line.

A Public Company - e.g., AMZN, NVDA, GOOG, AAPL, MSFT….

Let’s start at the top: highest valuation and lowest risk. A publicly traded company would fit here and public equity investors (hedge funds, mutual funds, individual investors) are the targets. Relative to the other stages we’ll discuss, this is the lowest risk investment. Why? In general (and this is by no means written in stone), these companies have:

Leadership.

Product.

Customers / users.

Revenue.

Some sort of profit.

Liquidity - i.e., can be easily sold (or bought) via a reputable exchange.

The questions investors are asking of a potential investment at this stage are things like:

Is it undervalued?

Is growth accelerating?

Are margins expanding?

Are metrics exceeding expectations?

Pre-Public Company Nearing IPO - e.g., CoreWeave, Stripe….

Slide down that line a bit and we’ll find a company appropriate for growth equity funds like Tiger Global, TPG, and General Atlantic. Liquidity is considerably lower here because you can’t buy or sell the investment on a public exchange (because it’s not a public company). That said, the company is closer to IPO and there are secondary markets (like Hiive, Equitybee, Forge) for people trading private stock. The company likely also has customers, revenue, and some sort of profitability. Questions investors are asking here (aside from the ones above) include:

When is the next liquidity event (IPO, M&A, etc.)?

Do revenue and profitability growth justify the valuation?

Is this the premium company in a hot new space?

Venture-backed Companies (Series B+) - e.g., Fireworks, Oishii, Novo….

Now we’re getting closer to the actual startup universe. A more traditional later-stage venture fund like a16z or Sequoia will do Series B, C, and later rounds in companies with a solid team, good product, user traction, and revenue…. But the big question here (in addition to all of the ones above) is can they turn a profit; i.e., does the business model work and scale.

Venture-backed Companies (Series A+) - e.g., Dystil AI, Inversion, Monkey Tilt….

Series A companies will have a good team and product and likely a decent and growing user base. But these investors like ENIAC Ventures, FRC, and Union Square Ventures will ask: will those users pay? I.e., can we expect revenue to scale…?

Seed / Preseed - e.g., YC, Techstars, ERA portfolio companies….

Now we’re at seed stage companies, which (along with preseed) is where I see the most volume of questions (though that also can be related to my swimming lanes, which lean heavily toward early stage). This is where we see accelerators, (institutional) angels, and (very) early stage funds searching for opportunities. This is also where startups are in the product-market-fit (PMF) stage of their lifeline so they’ll have leadership and a product, but will anybody use that product aside from their mother?

Friends and family - e.g., <- ask your friends and family ;-)

Finally, we’re at concept / preproduct where your baby startup is but a twinkle in your founder eyes, though you need a shtickle of capital to induce the startup birthing process. I see a handful of founders attempt to raise money from (very) early stage investors (i.e., investors in aforementioned stages) when there isn’t even a product - i.e., you haven’t cleared the hurdle of hacking together an MVP. But your most likely sources of capital here are family and friends (and yourself). The primary question at this stage is: provided capital, can this founder / team create a product that will attract and scale revenue and profit producing customers to create a high growth, category defining, highly valued company.

What does this mean?

Pitching the wrong (stage) investor (i.e., a sequencing error) is more common that it needs to be. Knowing where you are in your company’s lifeline and which risks you’ve mitigated should help narrow down your universe of potential investors. After that (and your pitch and your business), you’re on the rollercoaster on your own 🙂